Inadequate employment by City Power and under-investment in infrastructure gives rise to the high level of faults in the electrical reticulation system. To compound the issue the rapid rise in electricity charges now aggravates the city’s revenue shortfall.

South African municipalities enjoy a monopoly on the provision of essential services (electricity, water, refuse removal etc.). This allows local government to unilaterally set the price households and businesses have to pay for such services. The upshot of this is that municipalities have, for some decades, raised the cost of their services faster than the inflation rate and improvements in household income. The City of Johannesburg (CoJ) is no exception to this trend – every year increases in service charges have exceeded the inflation rate. These increases have largely been justified by the municipality having to buy services from ESKOM and Water Boards which supply bulk services to it. These state entities have raised their charges more rapidly than household income or inflation.

The practice, at least initially, benefited municipalities as their revenue rose in tandem with the increased bulk charges. Conversely, household disposable income was negatively impacted as they had to pay ever more for electricity and water as well as for sewerage services, refuse removal, etc.

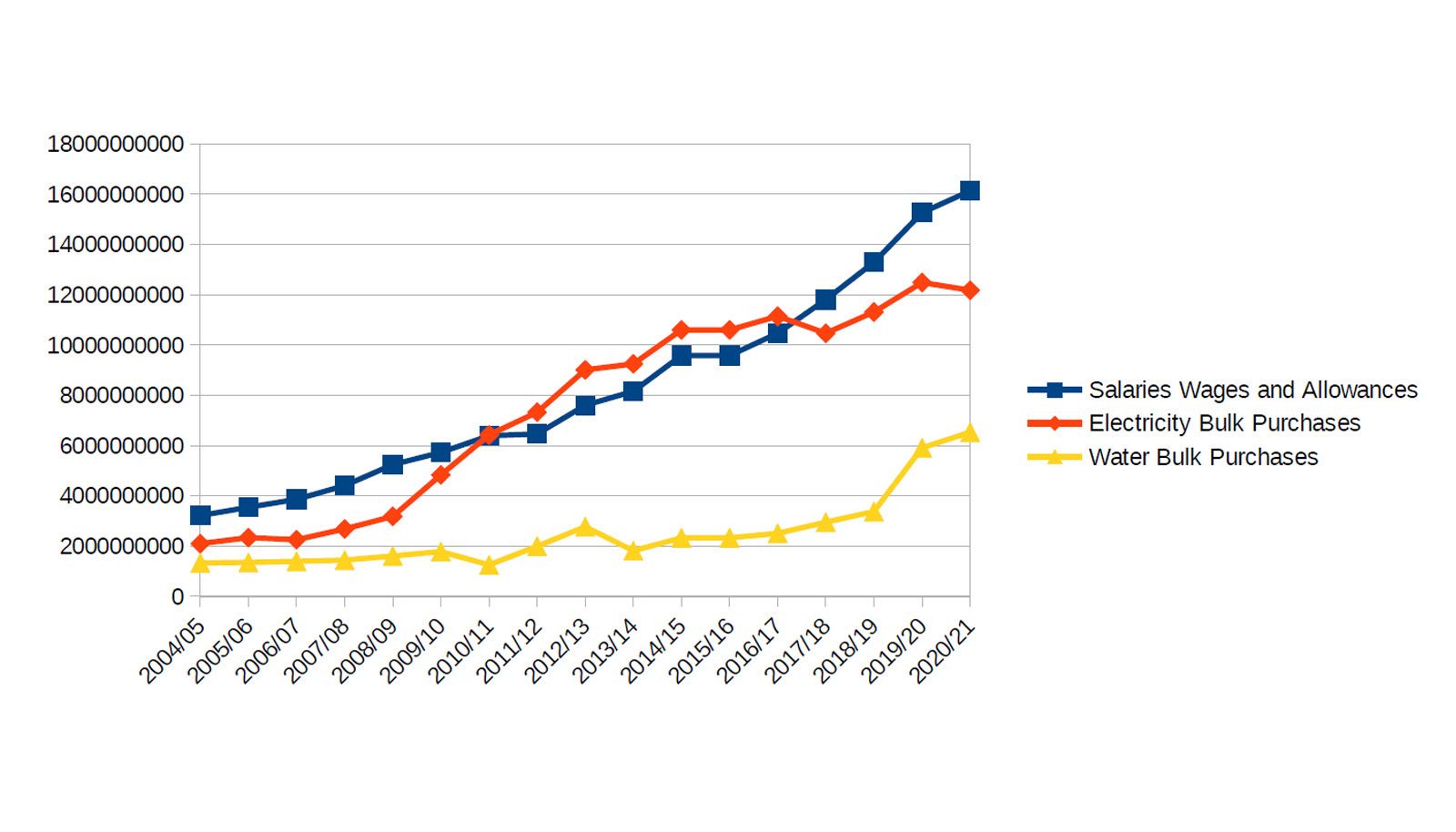

The rapid rise in charges was routinely attributed to increases in charges for bulk services as well as the desire of municipalities to redistribute resources to less developed areas. Over time the latter justification has become increasingly questionable as it became clear that all the benefits of the excess revenue are not passed on to indigent households or less developed areas. CoJ municipal finances highlight the inordinate extent to which the benefits accrue to the city administrators in general and to city employees in particular. Over the past few decades, the city’s wage bill has risen more rapidly than even ESKOM charges.

The increasing wage bill should not be attributed to higher employment by the council. For many city agencies, the level of employment has declined markedly. City Power (CP) the entity responsible for the provision of electricity across Johannesburg is a case in point. The number of people employed by CP is declining and has dropped markedly in recent years. In 2018/19 (the last year for which the figures are available) City Power employed about 1300 workers – one-third of the number employed in 2012/13.

To combat abuse of overtime by City Power workers City Power implemented a new shift system. Prior to the new system many workers CP could, reputedly, double or treble their earnings. In 2013 CP workers embarked on a strike to prevent the introduction of the shift system. Since the strike failed the number of workers employed by City Power has declined every year.

The decline in City Power employment levels is overshadowed by the reduction in capital investment in the electrical infrastructure. In 2014/15 capital expenditure on electricity infrastructure was R2.2-billion (with a B). The allocation has dropped every year since then. This year only R310-million (with an M) has been budgeted for capital investment. Capital Expenditure thus stands at less than one-sixth of the 2014/15 level. Once the impact of inflation is taken into consideration current CAPEX investment amounts to about one-ninth that of 2014/15.

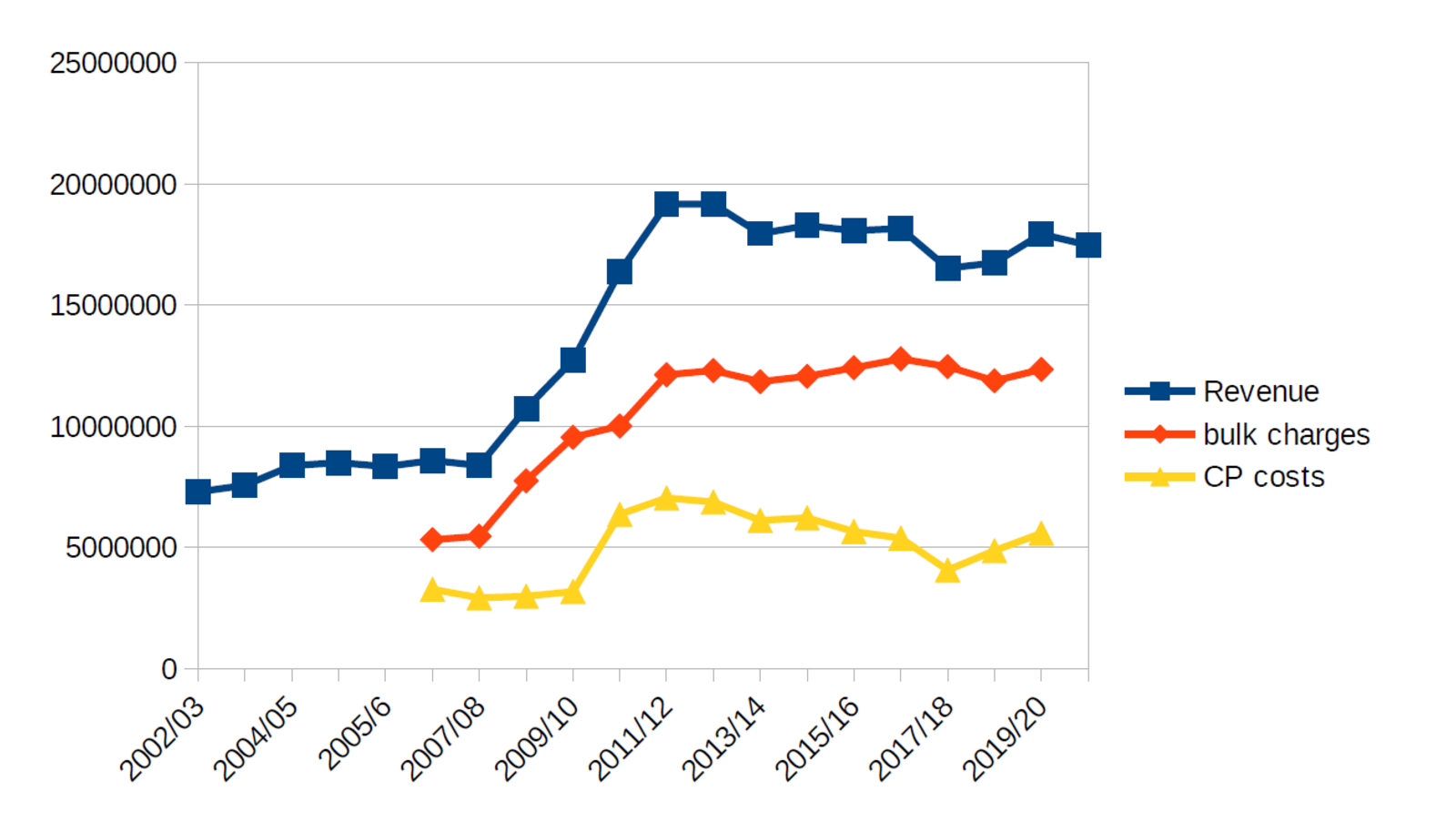

Despite the marked decline in both capital expenditure and employment levels, the revenue accruing to CP (at least nominally) continued to rise. Clearly ESKOM, by increasing its bulk charges, takes an increasing share of the revenue. Once this cost component has been removed from CP finances, it becomes apparent that CP cost to residents has not declined significantly. Only once inflation is taken into account does a decline in the cost of CP become apparent.

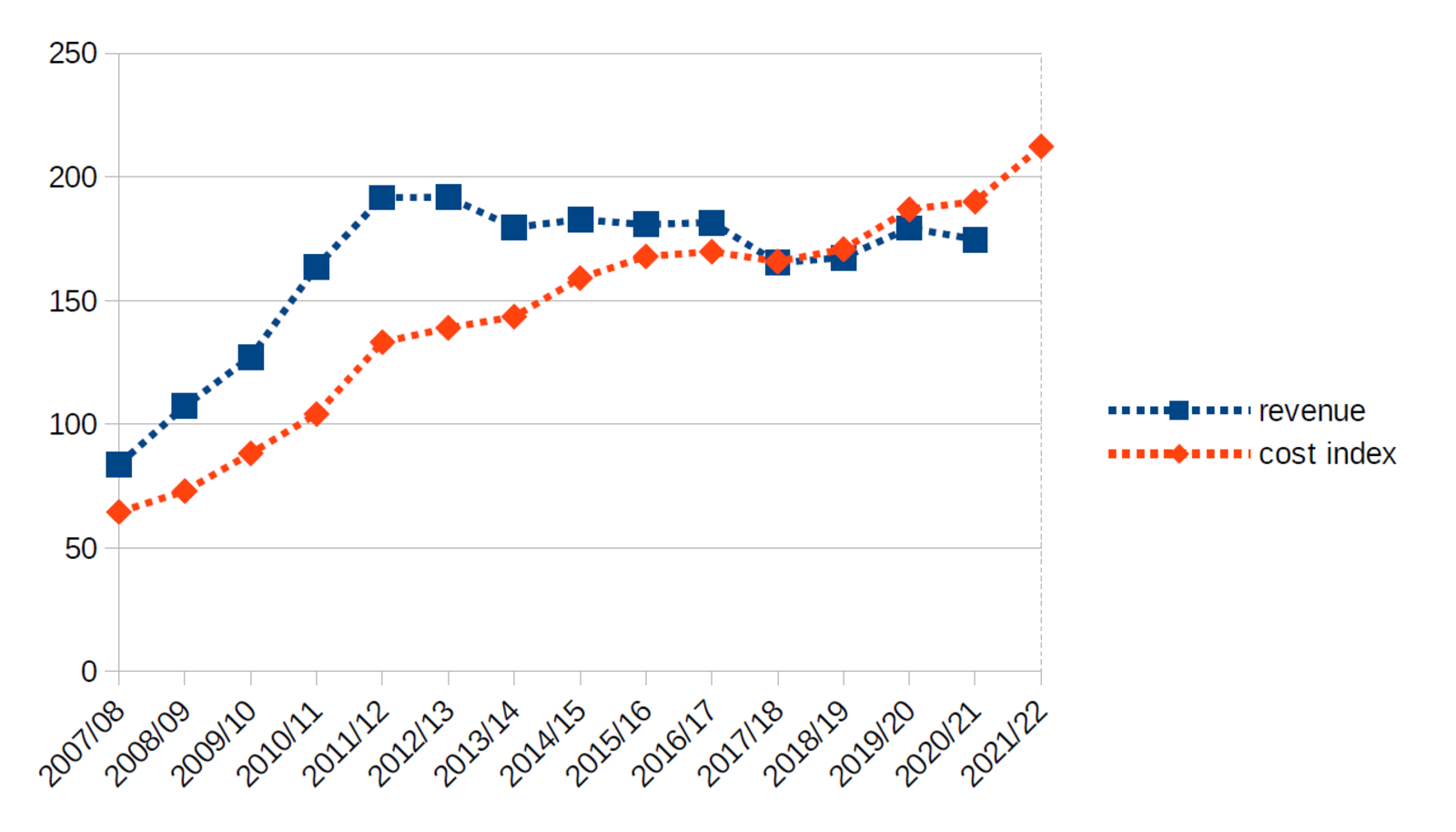

Over the past ten years, the cost of each unit of electricity purchased by an average Johannesburg household has risen by 150%. Once inflation has been taken into consideration, that increase amounts to “only” 60% for households. Accounting for inflation ameliorates somewhat the impact of price increases on households. However, it also makes a substantial difference to the understanding of the impact of price increases on CP revenue.

In real terms, the total revenue accruing to city Power (including capital expenditure, wages, administration costs, outsourcing and bulk purchases, etc.) has been on a slightly downward trajectory since 2012/13. That decline has corresponded to the noted reduction in capital investment and staffing levels. Pivotally the decline in real CP revenue must be seen as the impact of increasing electricity tariffs.

For decades, an above-inflation increase in electricity tariffs, prompted largely by the need to cover rising bulk purchase costs, resulted in increased real revenue for City Power. However, over time these increases whittled away at households and businesses’ ability to pay for what they consumed. Consequently, consumption levels and payment rates have declined. Since 2011/12 above-inflation increases in electricity tariffs have correlated to less revenue for the City. While the impact may be offset by more rigorous credit control by the city the key point remains – real increases in service charges now correlate to declining City revenue (in real terms). After the 2011/12 additional real increases in tariffs resulted in even greater reductions in electricity consumption (or by consumers falling into arrears).

This scenario implies that revenue may be increased by dropping the price of electricity NOT by constantly increasing it. However, a reduction is almost impossible given ESKOM’s recent behaviour and NERSA’s short-sightedness. ESKOM has an adventurous approach with respect to raising the price of bulk electricity and it is virtually guaranteed that the price of electricity will rise even more rapidly in the next few years. Simple economic principles indicate that rises in electricity charges contribute to lower demand for ESKOM’s product. Perversely ESKOM will, in the short term, be happy with this situation as demand on their infrastructure (and the prospect of load shedding) is reduced.

Unfortunately, the standard practice in Johannesburg is to aggravate the situation. The City seemingly treats all electricity costs as if they are linked to bulk charges and habitually raises the other cost components of the electricity in line with the ESKOM charge. If, for example, NERSA mandates a 20% increase in the bulk charges, the City routinely increases other cost components by twenty percent – 20 percent…

Prior to 2011/12, this may have resulted in increased revenue, but this no longer seems to be the case. Real increases in service charges now result in declining revenue for the City (i.e. after bulk payments have been made). Given the extent that CoJ relies on electrical surcharges to generate revenue for other operations, the reduction in CP earnings will affect City finances as a whole. Moreover, a similar revenue ceiling seems to apply to another significant source of city revenue – the provision of potable water. Residents and businesses have been subject to similar real increases in charges for water provision. Moreover, it seems that these charges also not no longer result in greater revenue for the City.

Unless the City is able to shift the revenue burden onto ratepayers (and this is improbable given the flight of middle-class residents), it will have to rely on a major turnaround in the economic growth rate to rescue City finances. Given that a notable increase in the national growth or employment rates is improbable, the City may have little recourse but to resort to the most obvious solutions – improving productivity (including employees) and instituting appropriate service and maintenance levels. Unfortunately, a more likely response will be increased borrowing, pleading for support from National Treasury, and punitive measures against consumers who are proactive (like going solar).

READ MORE

- Commentary on CoJ's proposed tariff charges and budget for 2022/23

You can also read the full report issued by the Public Protector regarding Mr Freddie Nyathela's 17-year-long battle with the City of Johannesburg to fix a billing issue.

Written by: Michael O'Donovan; Data Analyst